aurora co sales tax rate

The median property tax in Wake County North Carolina is 1793 per year for a home worth the median value of 222300. Centennial is a part of the DenverAuroraLakewood CO Metropolitan Statistical Area and the Front.

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Some of the very best heroes overall in hero wars include astaroth martha aurora lars krista karkh and jorgen.

. Please consult your financial tax or other advisors to learn more about how state-based benefits and limitations would apply to your specific circumstance. Alienware Aurora R14 Liquid Cooled Gaming Desktop - AMD Ryzen 9 5900 32GB 3466MHz RAM 1TB SDD 2TB HDD NVIDIA GeForce RTX 3080 10GB GDDR6X Graphics VR Ready USB-C Windows 11 Home Black. Get the latest news and analysis in the stock market today including national and world stock market news business news financial news and more.

Alameda Parkway Aurora CO 80012. However because of numerous additional county and city sales taxes actual combined rates can be as high as 1120. Tax on Services.

The bill also has an ongoing 150 million income and. View the printable version of city rates PDF. Our fundamental objective is to make sure each guest receives the most intimate experience possible whether.

Visit Stevinson Toyota East for details. Get breaking Finance news and the latest business articles from AOL. Miller Colorado Jeep is a distinguished Jeep dealer serving Denver Aurora Thornton and the Denver CO area.

Email email protected. Alameda Parkway Aurora CO 80012. With plenty of characters of different abilities at your disposal creating the best possible team in hero wars can be tough.

Colorado has state sales tax of 29 and allows local governments to collect a local option sales tax of up to 8There are a total of 279 local tax jurisdictions across the state collecting an average local tax of 4091. Combined with the state sales tax the highest sales tax rate in Colorado is 112 in the cities. The rate on the 30-year fixed mortgage jumped to 589 from 566 the week prior according to Freddie Mac.

Click here for a larger sales tax map or here for a sales tax table. Advertised price includes 599 Delivery Handling Fee. Name Local Code Local Rate Total Rate.

The legislation has a 410 million annual increase through sales taxes for education as well as a 500 million income tax rebate this year. Special Event Tax Return. Colorado has 560 special sales tax jurisdictions with local sales taxes in.

Sales Tax General Information. Email email protected Google Translate Disclaimer. Aurora sales tax applies to the retail sale or rental of all tangible personal property.

The availability of tax advantages or other benefits may be contingent on meeting other requirements. The latest sales tax rates for cities in Colorado CO state. One of the campaigns against incorporation appealed to voters to maintain the 38 sales tax of the unincorporated county According to the City of Centennial website the current sales tax rate is two-and-a-half times the promised rate.

The Centennial State has a flat income tax rate of 450 and one of the lowest statewide sales taxes in the country at just 290. Download city rates. Miller Colorado Jeep has a unique and crucial reputation of providing wonderful automotive services in the Denver metro.

Counties and cities can charge an additional local sales tax of up to 71 for a maximum possible combined sales tax of 10. Real estate California power prices soar to highest since 2020. Groceries and prescription drugs are exempt from the Colorado sales tax.

The Colorado state sales tax rate is 29 and the average CO sales tax after local surtaxes is 744. City Sales and Use Tax. Rates include state county and city taxes.

Our daily rate to park and ride light rail is now only 1 at Iliff Station Garage. You may also contact your home states 529 plans or any other 529 plan to learn. Wake County collects on average 081 of a propertys assessed fair market value as property tax.

It also applies to the retail sale of certain services that are listed below. Best campaign and tower team 3. 2020 rates included for use while preparing your income tax deduction.

The University of Colorado as a public institution of higher education of the State of Colorado is exempt by law from all federal excise taxes and from all Colorado State and local government sales and use taxes when purchasing goods or services in the conduct of official University business IRS 484221-5 and CRS. Sales tax finance charges cost of emissions test other governmental fees or taxes and transportation costs incurred after the sale to deliver the vehicle to the purchaser at the purchasers request are additional to the advertised price. Wake County has one of the highest median property taxes in the United States and is ranked 571st of the 3143 counties in order of median property taxes.

From stock market news to jobs and real estate it can all be found here.

How Colorado Taxes Work Auto Dealers Dealr Tax

Aurora Colorado Sales Tax Rate Sales Taxes By City September 2022

Kansas Sales Tax Rates By City County 2022

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Illinois Car Sales Tax Countryside Autobarn Volkswagen

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

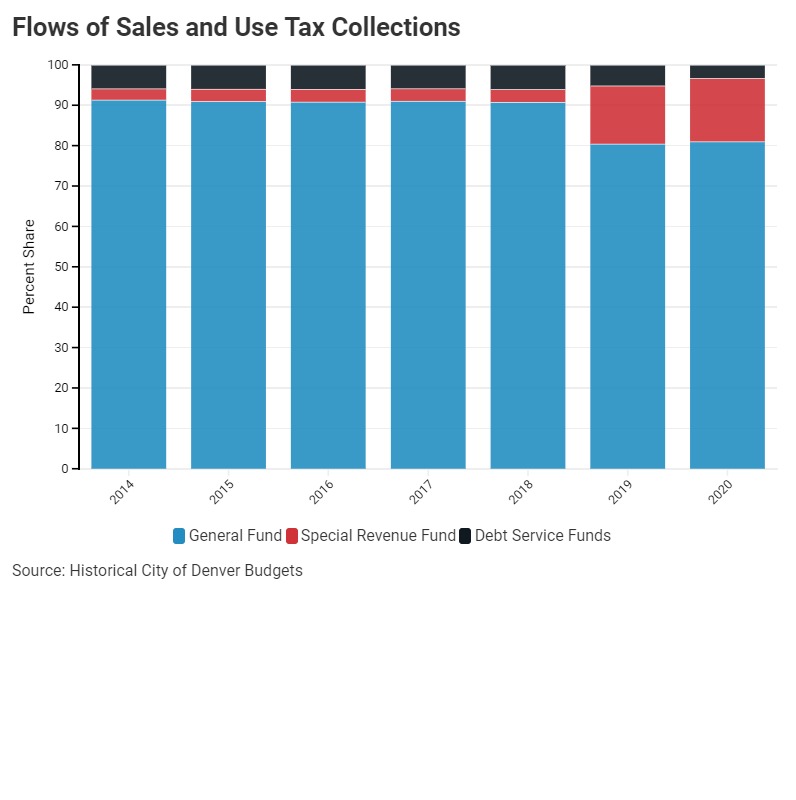

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Aurora Kane County Illinois Sales Tax Rate

U S Property Taxes Comparing Residential And Commercial Rates Across States

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

How Colorado Taxes Work Auto Dealers Dealr Tax

State And Local Sales Tax Rates 2013 Map Income Tax Property Tax